A citizen who provides accomodation services in rooms or appartements is obliged to:

- possess the Approval for renting rooms and/or apartments with accommodation categorization

- the price list of services visibly displayed in each room or apartment and have it in the books,

- determine the norms of food, drinks and beverages, if such services are provided,

- at the main entrance to the facility place a standardized board with aproved category,

- each accommodation unit must have an evacuation plan, which must be displayed on the inside of the entrance door or in the immediate vicinity,

- highlight house rules,

- an available complaint form,

- have a first aid box in each apartment or room,

- check in and check out guests in the eVisitor system within 24 hours after arrival, i.e. departure, the eVisitor system has a built-in list of tourists, and based on the Rulebook on the guest book, the guest list and the guest book no longer need to be kept manually,

- the "Traffic Record" (Evidencija prometa) book should be kept for each performed service,

- issue an invoice to the guest with the number, type, quantity and price, and keep a copy of that invoice in the block for yourself,

- When advertising and promoting services and displaying information in promotional materials, the accommodation provider must not use a designation of the prescribed type and category of the facility that has not been determined by the Approval for renting rooms and/or apartments with accommodation categorization

- pay the annual flat-rate amount of residence tax,

- and pay the tourist membership fee

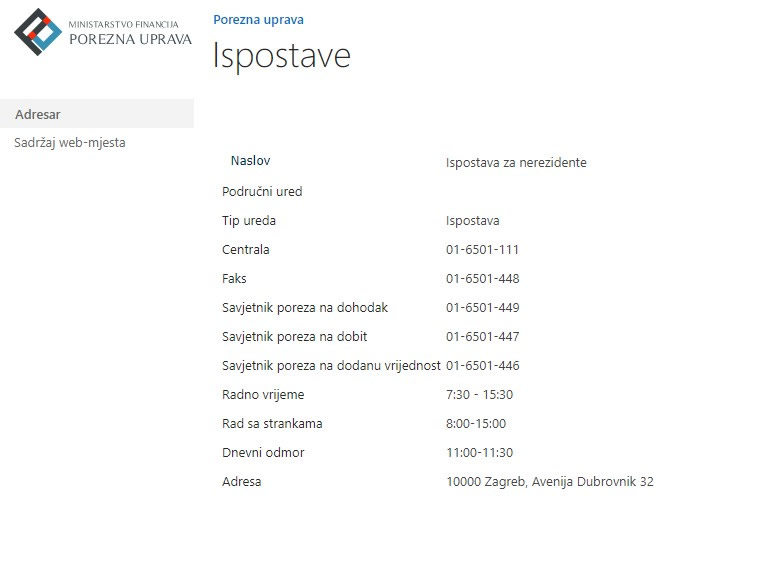

- for TAX obligation please contact TAX ADMINISTRATION FOR FOREIGN CITIZENS in Zagreb: POREZNA UPRAVA, ISPOSTAVA ZA NEREZIDENTE, 10 000 ZAGREB, AVENIJA DUBROVNIK 32

Request for the Approval for renting rooms and/or apartments with accommodation categorization

Accomodation services in a household can be provided by a natural person who is a citizen of the Republic of Croatia and citizens of other member states of the European Economic Area and the Swiss Confederation.

For the Approval for renting rooms and/or apartments with accommodation categorization in the household, the lessor is obliged to have the Approval for renting rooms and/or apartments with accommodation categorization from the competent office.

The request is submitted to the Office of the State Administration in Primorje-Gorski Kotar County, Economic Department, Opatija Branch, or in Croatian:

Ured državne uprave u Primorsko goranskoj županiji, Služba za gospodarstvo,

Ispostava Opatija,

Maršala Tita 4, 51410 Opatija,

Tel: 051 354 677, 051 354 673, 051 354 670.

e-mail: gospodarstvo.opatija@pgz.hr

You can get more information about the process in the above mentioned office.

1. Request for the Approval for renting rooms and/or apartments with accommodation categorization can be downloaded here:

https://www2.pgz.hr/doc/dokumenti/2020/obrasci/gospodarstvo/ot/OBRAZAC17.pdf

2. Request for deregistration of the Approval (submitted at the same State Administration Office where the Request is submitted)

https://www.icici-tourism.com/upload/pdf/2024/OBRAZAC_19._ODJAVA-GRA%C4%90ANINA-U-DOMA%C4%86INSTVU.pdf

The documents that must be submitted together with the Request are:

1. Copy of the identity card for citizens of the European Union and citizens of the European Economic Area

2. An extract from the land register not older than 6 months, which proves that he is the owner of the room or apartment. If the building is co-owned, it is necessary to attach the consent of all co-owners, which can be given to this Service

3. Evidence of the usability of the building in which the facility is located in accordance with the provisions of Article 175 of the Construction Act

4. Form - conditions for categorizing a room / apartment / studio apartment / holiday home - at www.mint.hr - Rulebook on classification and categorization of facilities where catering services are provided in the household

- print:

APPENDIX I. - CONDITIONS FOR ROOM AND STUDIO APARTMENT CATEGORIESAPPENDIX

II. - CONDITIONS FOR THE CATEGORIES OF APARTMENTS AND HOLIDAY HOMES

5. Administrative fee in the amount of EUR 9.29

Recipient: State Budget of the Republic of Croatia

Recipient's IBAN: HR12 1001 0051 863 000160

Model: 64Call to recipient number: 5002 - 29429 - OIB

Payment description: State administrative fees

After You receive the Approval for renting rooms and/or apartments with accommodation categorization, You are obliged to place in a visible place a standardized board with approved category.

You can find the companies that have received approval for the production of standardized boards here:

Check-in and check-out of guests at the Tourist Board of Ičići

The

lessor is obliged to register and de-register the stay of each guest within 24

hours, through the information system for guest registration and

de-registration on the website www.evisitor.hr (Regulations on the manner of

keeping a list of tourists and on the form and content of the tourist

registration form to the tourist community, NN 126/15).

Financial obligations of the renter

Ø Payment of tourist tax, flat rate

Ø Payment of the tourist membership fee, flat rate

Ø For TAX payment please contact TAX ADMINISTRATION FOR FOREIGN CITIZENS in Zagreb: POREZNA UPRAVA, ISPOSTAVA ZA NEREZIDENTE, 10 000 ZAGREB, AVENIJA DUBROVNIK 32

TOURIST TAX FOR 2026. YEAR

Payment of the tourist tax in a flat amount is an obligation for all renters who provide accommodation services in a household or on a family farm for each bed (basic and auxiliary).

According to the Decision of the County Assembly, the amount of the annual flat-rate amount of the tourist tax for accommodation services in a household for 2026 was determined in the amount of EUR 55,00 for each bed registered in eVisitor.

Persons who are liable to pay the tourist tax in three equal installments, namely: the first installment by July 31, the second by August 31, and the third by September 30 of the current year.

Payment slips are available in the eVisitor system under the section Finances - Payment slip, as well as on the home page (link Payment slip).

By selecting an object, a payment slip is generated for the selected object, and it is possible to choose the type of amount with a total debit or in three payment slips. The system provides the possibility to download a document in the form of a HUB template or an image of a payment slip.

|

PAYER |

LESSOR'S NAME AND SURNAME |

|

RECEIVER: |

PROLAZNI RAČUN TURISTIČKA PRISTOJBA |

|

MODEL: |

HR67 |

|

RECEIVER'S ACCOUNT NUMBER: |

HR27 1001005 1730247048 |

|

APPROVAL NUMBER: |

OIB of the lessor (11 digits) |

|

DESCRIPTION OF PAYMENT: |

TURISTIČKA PRISTOJBA 2026 |

According to Article 12 of the Tourist Fee Act, the tourist tax is paid in an annual flat-rate amount, i.e. the entire flat-rate amount is charged regardless of the period in which the capacity in which the economic activity is carried out is registered (the same calculation for a facility that operates for 1 day or 12 months).

Pursuant to Article 12 of the same Act, the calculation will be made for the largest number of beds/accommodation units registered in the current year in the same municipality/city.

For newly registered capacity that increases the number of beds/accommodation units in the same municipality/city, a corrective calculation of the flat rate will occur, i.e. the flat rate will increase.

If the number of beds/accommodation units is reduced in the facility during the year or the solution is terminated, the charge will not change.

TOURIST MEMBERSHIP FEE AND SUBMISION OF TZ2 FORM TO THE TAX ADMINISTRATION (Porezna uprava)

Considering the legal obligation to submit Form TZ2 to the Tax Administration, we hereby

inform all accommodation providers from the area of Ičići of their

obligation to submit the Form TZ2 for the year 2026.

Form TZ2

must be submitted EXCLUSIVELY electronically via the ePorezna / m-Porezna

system, which can

be accessed via the following link:

https://e-porezna.porezna-uprava.hr/Prijava.aspx

Forms are no longer accepted by personal delivery to the Tax Administration offices nor by e-mail.

The form may be submitted online only, in the period from 1 to 15 January 2026.

Instructions for completing Form TZ2 ELECTRONICALLY

Tax Administration regional office: according to place of residence or habitual residence

General information:

Personal Identification Number (OIB)

Name and surname

Address

Municipality/city code or name

Membership

fee calculation period:

01/01/2026 – 31/12/2026Item

Numbers

in the form:

1 – Number of main beds

2 – Number of extra beds

9 – Total calculated amount

16 – Method of payment (lump sum / instalments)

17 – Total income in 2025 (according to Form EP - "the Traffic Record")

Calculation of the amount

Number of main beds × €5.97

Number of extra beds × €2.99

Forms submitted before the start of the submission period will be rejected.

Checking and submitting the form

After completing all required fields, follow these steps:

Click the "Check” button in the upper left corner.

If there is an error, the system will notify you and indicate what needs to be corrected.

If there are no errors, the system will display a confirmation message.

Once you are certain that all data is correct, click "Submit”.

Additional tips

Always double-check the entered data before submitting to avoid unnecessary errors.

Save the confirmation of submission of Form TZ2 for your records.

Form TZ2 may be submitted exclusively by the person to whom the accommodation categorization decision is issued.

Another person, including family members, may not submit the form using their own e-Citizens (eGrađani) account.

HOW TO ACCESS THE SYSTEM

Access is possible via:

Bank m-Token

FINA m-Token application

New electronic ID card

Certilia certificate

If you do not yet have access, you can request it at your bank or at FINA.

NON-RESIDENTS (persons who do NOT have residence in the Republic of Croatia)

- form TZ2 is also submitted via the ePorezna system

- if they do NOT have access to the system, they may grant a Power of Attorney to a person with residence in Croatia, an accounting service or a lawyer

Advice for non-residents:

In case of any uncertainties, please contact:

Tax

Administration – Zagreb Regional Office (Porezna uprava)

Non-Residents Branch

Avenija Dubrovnik 32

10000 Zagreb

Tel: +385 1 6501 111

Email: pisarnica.nerezidentni@porezna-uprava.hr

PAYMENT OF THE TOURIST MEMBERSHIP FEE for 2026.

The amounts of tourist membership fees as well as the payment slip, are visible to renters in eVisitor and are paid as follows:

|

PAYER |

LESSOR'S NAME AND SURNAME |

|

RECEIVER: |

TRANSIENT ACCOUNT TOURIST MEMBERSHIP FEE |

|

MODEL: |

HR67 |

|

RECEIVER'S ACCOUNT NUMBER: |

HR84 1001005 1730227204 |

|

APPROVAL NUMBER: |

OIB of the lessor (11 digits) |

|

DESCRIPTION OF PAYMENT: |

TURISTIČKA ČLANARINA ZA 2026 |

In the case of a subscription to the tourist membership fee, the renter should contact the competent office of the Tax Administration, which will determine the justification of the refund request.

Namely, based on Article 12 of the Law on Membership Fees in Tourist Associations, the Tax Administration is responsible for calculating, recording and collecting membership fees. If the competent Tax Administration determines that the request is justified, it will send an order to FINA for refund.

ADDITIONAL INFORMATION FOR RENTERS NON-RESIDENTS – persons whose place of residence is OUTSIDE the Republic of Croatia

According to the Income Tax Act, a non-resident is a person who has neither a domicile nor a habitual residence in the Republic of Croatia, and earns income there that is taxed in accordance with that Act.

Non-residents are obliged to report to the Zagreb Tax Administration, Office for non-residents / Porezna uprava Ispostava za nerezidente: